TuyauPay is a cross-border wallet designed for fast, transparent money movement between Canada and Nigeria.

Client

Nimbus Global Technologies Limited

Duration

2 Weeks

Date

Sep 2025

Visit Website

Preview Site

TuyauPay is a cross-border wallet designed for fast, transparent money movement between Canada and Nigeria. The product enables users to hold CAD and NGN, swap currencies instantly, and send money through Interac e-Transfer in Canada and local bank transfers in Nigeria—all within a single app.

The design challenge was to reduce friction in everyday remittances while maintaining strong compliance and trust signals expected in financial products.

TuyauPay’s goal is to make Canada–Nigeria payments feel as simple as local transfers.

Core objectives:

Remove friction from wallet funding and currency exchange

Make fees, rates, and outcomes clear before confirmation

Support fast local rails (Interac + Nigerian banks)

Ensure regulatory compliance through Sumsub-powered KYC without harming completion rates

The product targets individuals and small businesses who need speed, clarity, and control—not complexity.

Design Priorities

Reduce cognitive load in all money-movement flows

Surface fees, rates, and outcomes before commitment

Keep KYC linear, guided, and easy to recover from

Use a single, consistent PIN pattern for sensitive actions

Solution

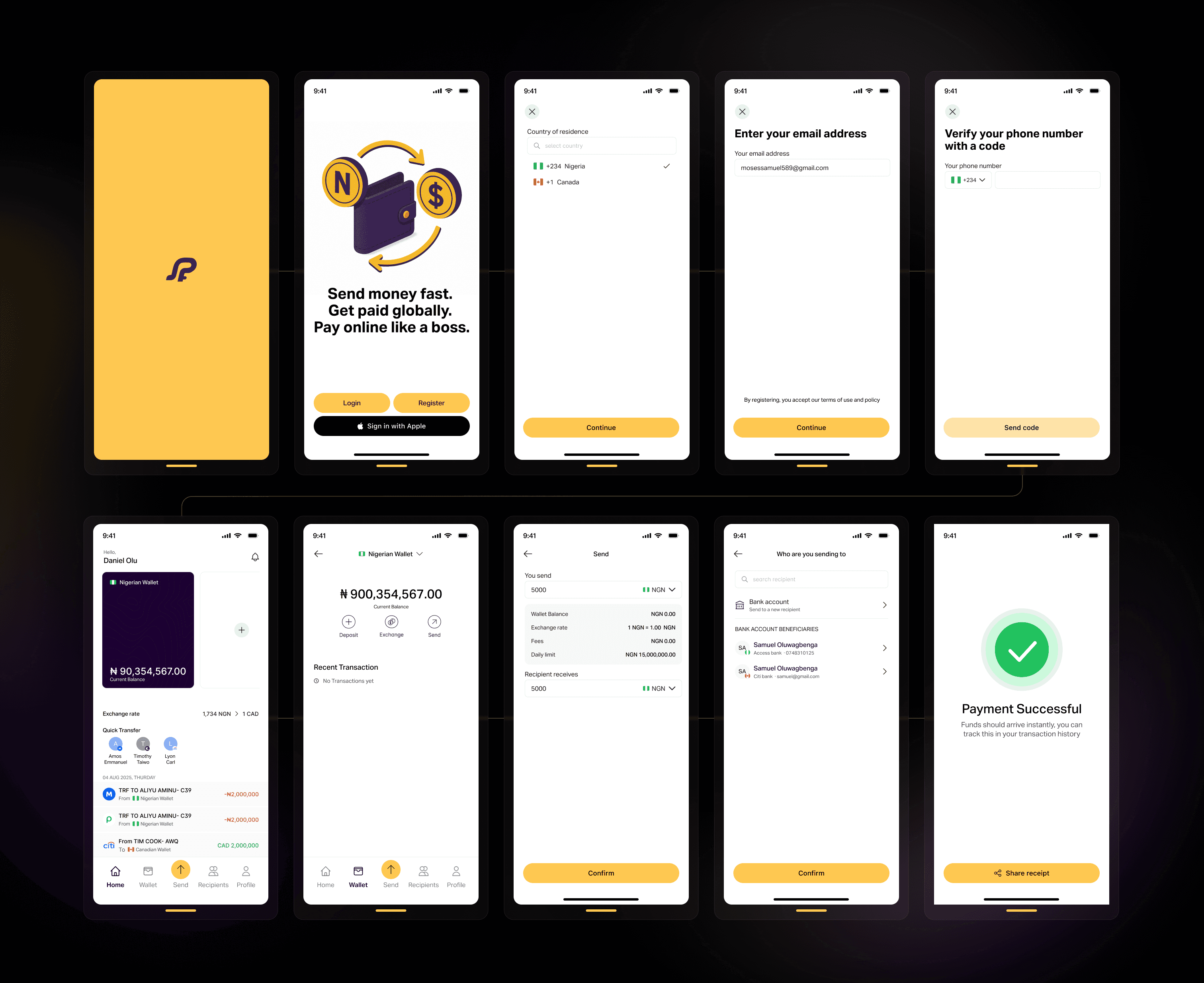

1. Fast Onboarding with Progressive Trust:

Users enter email, phone number, and country early to set compliance context

KYC is progressive, triggered only when required

Users reach the dashboard quickly instead of being blocked upfront

Why: Users should experience value before being asked for effort.

2. Dashboard as the Control Center pesents only what matters:

CAD and NGN wallet balances

Current exchange rate

Recent transactions

Primary actions: Fund, Swap, Send

Why: A clear dashboard reduces decision fatigue and reinforces control.

3. Predictable Send & Swap Flows:

Send flow: Enter amount, Select or add recipient, Review fees, rate, and arrival method, Confirm with PIN, Clear success or failure state

Swap flow: One-screen preview showing rate, amount received, and fees before confirmation

Why: Money movement should feel safe, obvious, and reversible—not clever.

4. Strong Feedback & Transparency

Explicit confirmation screens

Clear success and error messaging

Direct recovery actions (“Try again”, “Open wallet”)

Real-time transaction tracking with no hidden fees

Why:Trust is reinforced through clarity, not reassurance copy.

Outcome

The final experience delivers:

Faster task completion for sends and swaps

Reduced onboarding abandonment

Clear mental models around wallets, rates, and transfers

A product that feels modern while meeting regulatory expectations

TuyauPay balances speed, transparency, and compliance—without overloading the user.